You cannot afford to say ‘no’ to a customer when stores reopen. However, the reality of overstock issues from SS20, combined with less assortment for consumers in future seasons (see Monsoon Accessorize’s warning to suppliers) suggest that this is far more challenging than anyone could have predicted just a few months ago.

In the second of our respond, recover and reimage series, we focus our attention on Stock; in the short-term, how we respond to the current overstock issues and support staff return to stores and mid-term, how inventory & fulfilment can be reimagined to support new store formats.

If you would prefer to hear what we have to say instead of read, you can view a 25 minute recording of the webinar accompanying this article at the bottom of this page.

SHORT-TERM TACTICS

1. OverstockThe UK Warehousing Association commented in this article in the FT that the “lack of available warehouse space in the face of Covid-19 restrictions is reaching a critical point”, with capacity likely to be reached in the next few weeks. The situation is so dire that they have setup an emergency space register for retailers to temporarily move stock that can’t physically be stored in their own warehouses.

If we aren’t able to find solutions to the overstock crisis, the Retail Gazette suggests that Fashion retailers may have to write-off £15bn worth of spring and summer stock.

So, in short, we need to do all we can to try and sell-through stock as soon as possible to support cash flow and free up space for future, more relevant, collections.

What are retailers doing NOW to address overstock?

According to the Business of Fashion, some retailers, such as global giants Zara, H&M and Nike are looking to China to see how Virtual Vouchers are being used Instead of Deep Discounting. A clever way for the government to stimulate consumer spending, without a simple cash injection.

But what if we haven’t got time to wait for government stimulants and need to react now? We have four options: Sell, Destroy, Save or Give away. I would like to focus on the opportunities to generate sales, either now or in the future, and so have suggested a few tactics for you to consider in your short-term sell strategies.

Short-Term Recovery in Action

Bundling

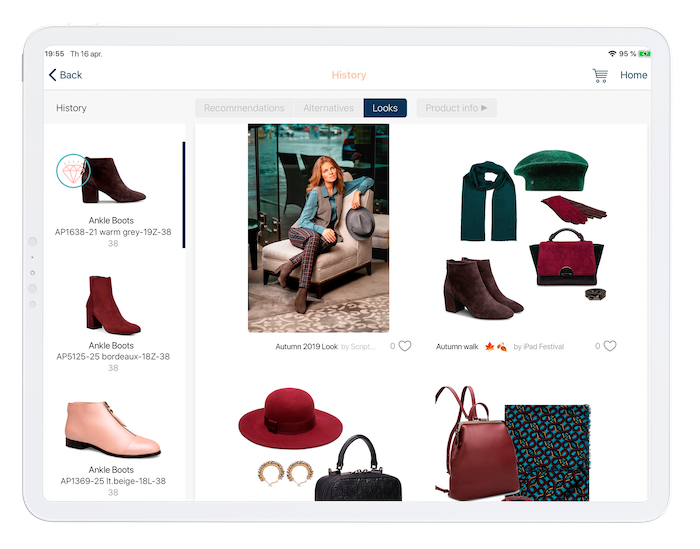

This tactic is a clever way of releasing stock in larger baskets. If the issue persists into subsequent season, we should also consider using this tactic to subtly bundle old stock with new. Below is an example of how bundling can be displayed using Mercaux’s Digital Styling solution to be sold by sales associates in-person or via 121 messaging with customers using Clienteling:

Clienteling

At Mercaux, our solutions not only support retailers when stores reopen, but are supporting them NOW whilst in lockdown. See how Ekonika is using Mercaux’s Clienteling solution to enable store associates to communicate with loyal customers from home to release as much SS20 stock at possible.

Content

With such a rich amount of content created by Sales Associates in the Mercaux App whilst stores were open, some Mercaux customers, such as Finn Flare and Chareul, have used Mercaux’s open API to display SS20 content on eCommerce or on social media.

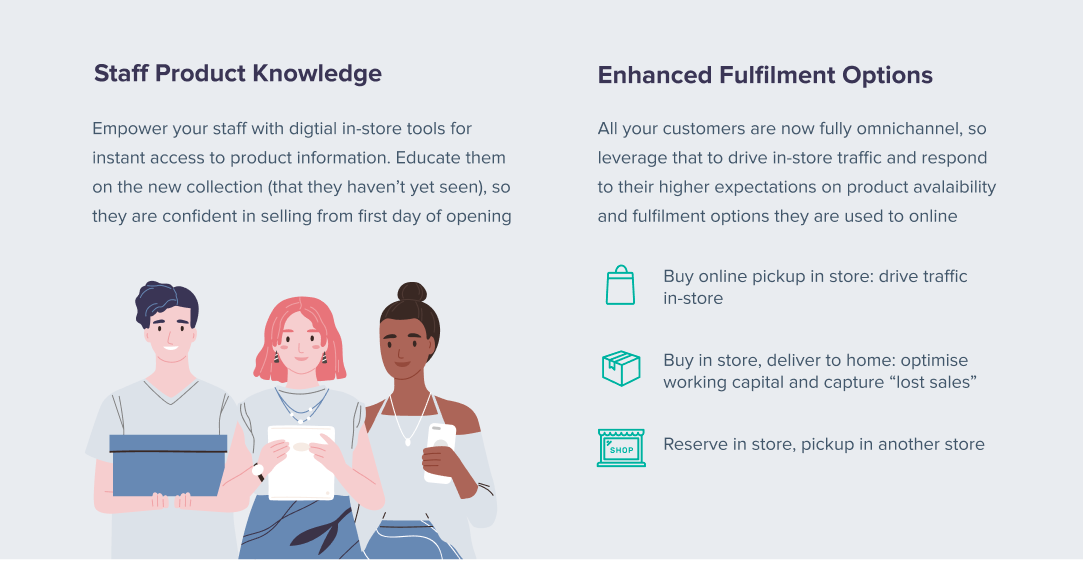

2. Product Knowledge

If the immediate challenge for retailers is to offload as much SS20 stock as possible, the very next challenge is how we can support Sales Associates return to stores and sell with a shop full of new season products.

Customers have been heavily exposed to information rich eCommerce sites whilst in lockdown; product descriptions, styling suggestions, alternatives and company-wide availability. Sales Associates will need the technologies that will support them in offering a similar level of service in-store.

3. Enhanced Fulfilment Options

In addition to inventory, offering flexible fulfilment options is another heightened expectation that will be held by the post-COVID-19 customer. Total Retail comment in their article, Why Flexible Fulfilment Options Are More Important Than Ever, “With the right processes in place, it can enable less resource-intensive sales for retailers as well as more options for busy consumers to get their goods in an efficient, safe and timely manner, which will drive customer loyalty.”

The uptake of new fulfilment options by your customers during this pandemic has been huge. McKinsey & Company released a report earlier this month into changing consumer behaviours and found that more than 50% of consumers using buy online pick up in store (BOPIS) are new to this method of fulfilment in the Italian market. Meaning that the expectation for retailers to facilitate this when stores reopen will be a lot higher.

Introducing these methods of fulfilment if you do not have them already should not be a large CAPEX-type project. In fact, in our recent “Pulse of Retail” survey it was revealed that 74% of CAPEX projects have either been put on hold or slowed during lockdown, meaning that it will become a challenge to obtain sign off for large re-platforming projects. Senior management and IT leaders should therefore be challenging technology providers who facilitate new fulfilment methods to provide solutions that can be deployed quickly for short-term gains and with minimal or no CAPEX investments to support you in your recovery.

MID-TERM STRATEGIES

The crisis has brought an acceleration in the need for retailers to deliver a truly omnichannel Unified Commerce experience (providing flexibility, continuity and consistency across digital and physical channels). Consider bringing the best practices of inventory and fulfilment together into new store formats.

We will be shortly covering new store formats in more detail. Please check back to read what we have to say in the final of our respond, recover and reimagine series into staff, stock and store.

A final note: Shops in Berlin were given the green light to open stores this week. The news that retailers around the world are longing to hear from their local markets, but as the Financial Times revealed, “what should have been a celebration felt more like a wake”.

Retailers should take this as sobering reminder that when stores do reopen, customers will take time to return to the numbers that were seen pre-crisis. For those that are willing to come back in those early days, you should reward them by meeting their heightened inventory and fulfilment needs by never putting yourself in a position to say ‘no’.

Post-COVID-19 Webinar recording